The most common question asked to Aswini Bajaj, a trainer and consultant, is how he managed to clear CA, CS, CFA, FRM, CAIA, CIPM, CCRA, CIRA, CIIB, AIM in the first attempt.

Following are some of the factors that helped him reach where he is now.

Firstly, it is the intrinsic motivation that drives you towards your goal. Ask yourself the “why.” It will push you to put in the required effort. Imagine it to be like a fixed deposit where you keep on investing and the benefits of which you enjoy throughout your life. Look at the long term instead of the short term.

Second, the value system you are brought up with molds you. Moreover, your family and friends should understand the importance of education and be your support system. There is a lot of cumulative effort that is at stake. Respecting time, money, and the efforts of yourself as well the people around you is important.

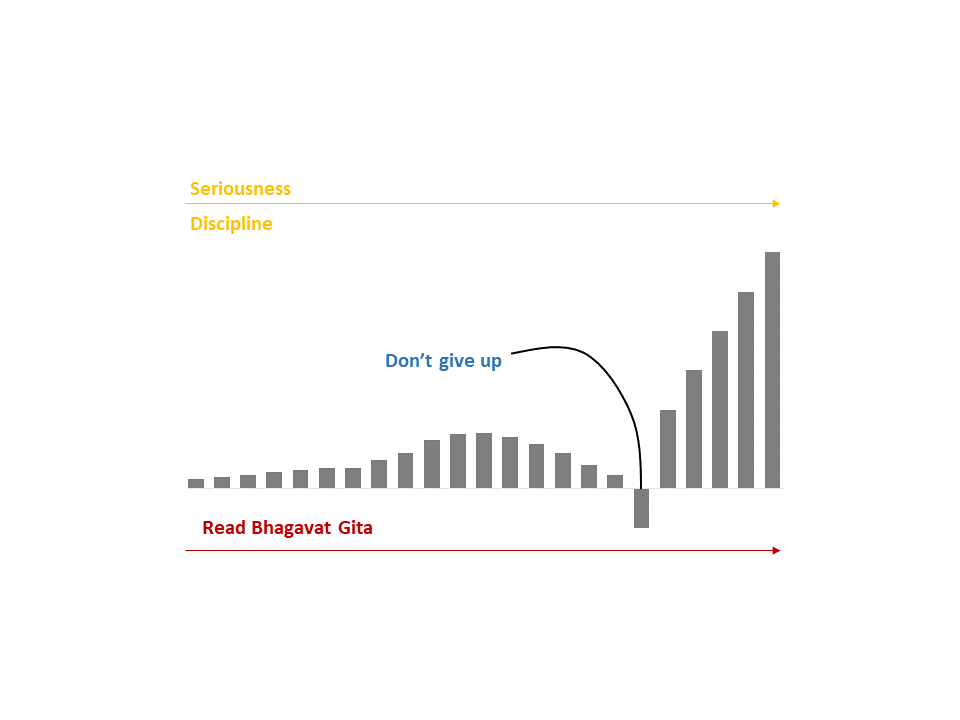

Third, consistency, hard work, and long stretches of studying are other salient features that make you productive. Understand the concepts rather than mugging up. It will make your foundation strong. Communicate with your seniors to learn from their experiences.

Lastly, you cannot fall ill before your exams. So eat right and feel right, because positivity is necessary. Reward yourself when you achieve a target. The little things matter and help you to push the envelope.

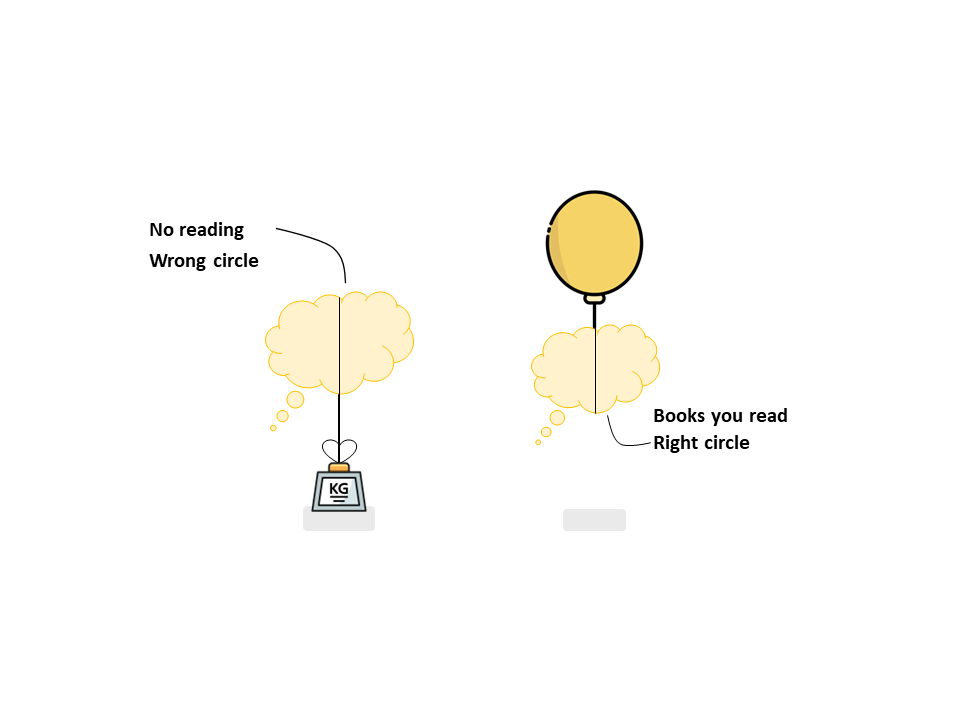

Most importantly, Invest In Yourself because there is no substitute.